Invoice without a company - Freelance smarter.

Create an account, send invoices, get paid. WorkNode provides a modern setup for freelancers who want simplicity now and better finances when things take off.

✓ No administration or accounting.

✓ You are insured during the assignment.

✓ You don't need to register a business (F-tax).

Over 10,000 freelancers have already taken the plunge

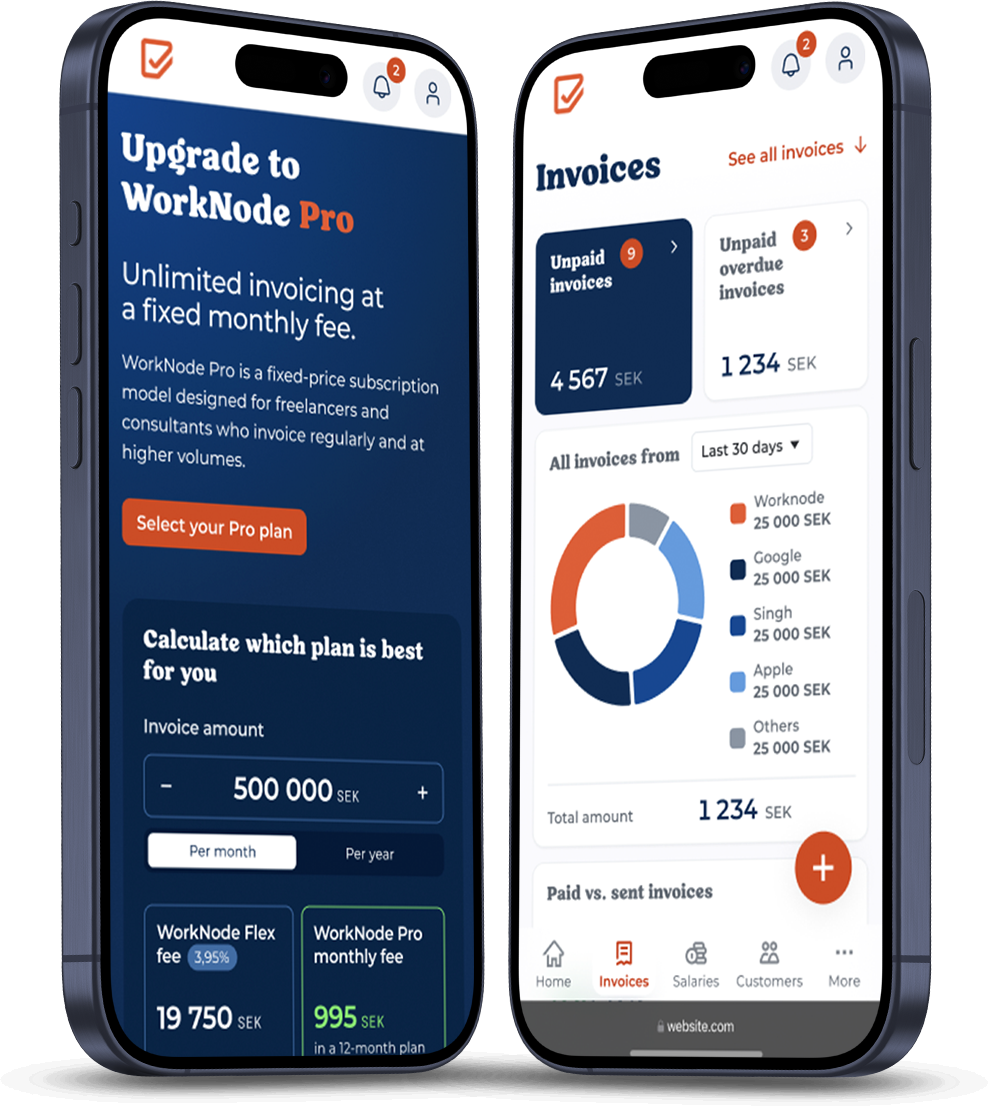

FLEX or PRO? You choose.

Whether you invoice occasionally or monthly, we have a solution to suit you. Choose between a flexible percentage fee or a fixed monthly rate - and get full peace of mind, support and employer responsibility in return.

Pay-as-you-go.

For those who invoice occasionally.

✓ 3.95% per invoice

✓ No fixed cost, no commitment period

✓ Easy start: bill directly, pay only when you use the service

3.95% of the invoiced amount

Fixed price.

For those who mean business.

✓ Fixed monthly price - unlimited billing

✓ Suitable for those who invoice 25 000+ SEK/month)

✓ Save thousands of dollars each month compared to percentage-based services

From SEK 995/month

A smarter way to freelance. On your terms.

WorkNode makes freelance life easy to live and easy to understand.

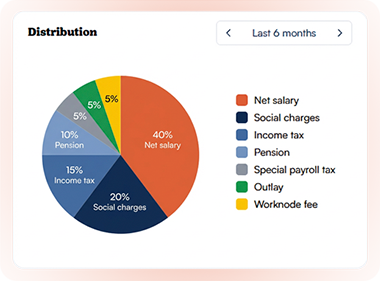

You get a salary, tax, pension and security in a system that lets you work freely without unnecessary fees.

Flexible when you want. Fixed when you need it.

Choose the way of freelancing that suits you - and keep more of what you earn.

How to get started with invoicing as a private individual

Create an account

Register and fill in the essential information - name, address and social security number - and you're good to go.

Send your invoice

Invoicing as a private individual via Worknode only takes a few minutes.

Then it's a matter of waiting for the payment from your client.

Get your salary in your account

As soon as your invoice is paid, you can receive your salary directly into your account. We'll take care of all the fees, VAT and taxes (and pension if you want).

Welcome to the world of easy invoicing without a company!

Everything you need for secure self-employment

-

Tax payment

Worknode pays the tax and social security contributions automatically once the customer has paid.

-

Insurance

When you invoice through Worknode, you are insured from the start. Our partnership with IF gives you comprehensive protection.

-

Declaration

Everything you earn through Worknode is reported automatically. You avoid extra administration when it's time to file your tax return.

-

Professional invoices

Send invoices that impress. Worknode makes sure everything looks professional and accurate - every time.

-

Low fee

Bill without a company at a really low cost. Choose between fixed or variable fee. No hidden costs.

-

Community & impact

At Worknode, you have a say. Help improve the service together with other freelancers in our network.

-

Pensions & savings

Want to save for retirement as a freelancer? We offer support and solutions to help you think long-term.

-

A partner in freelance life

Behind our support are real people. We'll help you quickly - whatever your question.

Find out how much you can get paid, with our calculator here!

Your success

is our passion

As freelancers ourselves, we know how important it is to have the right support to succeed. Worknode is the service that gives you the conditions to grow and succeed as a freelancer, whatever your goals or ambitions in freelancing.

That's why we offer you free advice on your freelance work. We help you with questions such as finding assignments, invoicing as an individual and what insurance you need to be safe. Working and invoicing without a company has never been easier!

Want to freelance without starting your own business? Worknode makes it easy!

Here's why you should choose Worknode:

Flexibility and

security in one

Focus on simplicity and profitability

Created by freelancers

for freelancers

No hidden fees - more money for you

Get paid

within 48h

Thousands of freelancers have realized how easy it is to invoice as a private individual. When you use Worknode, you get basic insurance, we take care of paying your salary and accounting for taxes and fees. Feel free to compare our low fee with similar services.

Most reliable

With Worknode, you're always properly insured. And you always get a lot of help from us if a customer doesn't pay on time. By the way, did you know that Worknode is a Swedish company? Our staff, board and management (and even the bank we use!) are based in Sweden - and we have a lot of experience in the Swedish freelance market.

Great freelance tips

As I said, we want you to succeed as a freelancer. So you can work and live your dream. That's why we're generous with tips on how to find assignments, how to set prices, how to market yourself and much, much more. Start subscribing to our newsletter and see you in your inbox!

Make time for what's important

Your time, energy - and not least joy - are valuable if you are to succeed as a freelancer. You need to be able to focus 100% on your assignment, what you do best, and not worry about administration. Freelancing often means a lot of (unpaid) work. With Worknode, you invoice easily, quickly and safely and can focus on what you earn.

Frequently asked questions about invoicing without a company

-

No! With Worknode you can invoice as a private individual. We take care of tax, VAT, social security contributions, pension and insurance.

-

As a rule, 25% VAT should be added when you invoice as a private individual. However, there are a number of exceptions.

For you who are an artist, when you invoice as a self-employed artist through Worknode, you must apply 25% VAT, according to the regulations Worknode follows. If your customer is a VAT-liable company, this does not affect you as the company has the right to offset input VAT against output VAT. If your customer is a private individual or association that is not required to account for VAT, your price must be 25% higher. Therefore, remember to state your price to private individuals and associations including VAT so that you receive the correct compensation.

Worknode has an obligation to manually approve VAT-exempt invoices before they are sent out to customers. It must then be clearly stated which VAT exemption is applicable to the invoice, this is written in the text line of the invoice.

Read more here.

-

Yes, you can invoice companies outside of Sweden. For invoices within the EU, a valid VAT number is required from the recipient. Supported currencies: EUR, USD, GBP, NOK, DKK, SEK. Salary payments are always made in SEK according to the bank's exchange rate.

-

With Worknode, those who want to invoice without a company can receive their salary in a fast and flexible way.

Under Finances/My Salary, you can specify whether you want to make manual withdrawals of your salary or whether you want your salary to be paid to you automatically once the invoice has been paid.

If you want to make manual withdrawals, your balance will be registered in your Worknode account the same afternoon that the payment from the customer arrives in the Worknode client funds account. You can then make a withdrawal and your salary will normally be paid the following day.

If you have indicated that you want automatic withdrawals, your salary will be registered on the same afternoon that your invoice arrives in the Worknode client funds account. It is then normally paid to your bank the following working day.

-

Worknode helps you create a correct invoice with just a few clicks. You fill in:

Customer information

Mission description

Amount and VAT

Payment terms

Your salary settings

The invoice is then sent directly to the customer.

-

Use our salary calculator ! It calculates how much you have to invoice to get your desired net salary after tax, social security contributions and our fee of 3.95%.

-

A guideline is to take your desired monthly salary, multiply by 12 and divide by 1,800 working hours/year. Add vacation, pension and unbilled time to get the right figure.

-

Yes, all users are automatically covered by insurance from If.

-

A credit memo is used to correct an incorrect invoice. It charges the previous amount (minus) so that you can send a new, correct invoice.

-

We send:

Reminder

Debt collection requirements

Final notice

If the customer does not pay despite this, you can proceed to the Swedish Enforcement Authority. Any dispute will be handled between you and the client, but we will help you through the process.

-

Yes. You must then provide the customer's social security number. In the case of an unpaid invoice, the social security number is required in order to be able to pursue the matter further to debt collection.

-

An invoice should contain:

Invoice date

Invoice number

Your and the customer's name & address

Description of service/goods

VAT and total amount

Customer's company registration number (company) or personal identification number (private individual)

-

Under Swedish law, a debt can be sent to debt collection if the invoice is still unpaid after two payment reminders. The first reminder can be sent at the earliest 14 days after the invoice was sent and the second reminder can be sent after another 14 days. If the customer still doesn't pay, the debt can be sent to debt collection.

-

Once the customer has paid the invoice, your salary is paid immediately and you will normally receive your salary within 1–2 banking days . You can see the status in real time on your Worknode account.