Invoicing without a company – how it will work in 2026

Want to take on assignments and get paid as a salary without starting your own company or registering for F-tax? On this page, we go through how invoicing works without a company, what you get left after taxes and fees, and how Worknode gives you a salary with a collective agreement, insurance, and security.

What does it mean to invoice without a company?

Invoicing without a company means that you perform assignments for a customer, but let a self-employment company such as Worknode act as your employer and invoice on your behalf. The customer receives a standard invoice, you receive your salary, and Worknode takes care of:

Invoicing to customers

Taxes and employer contributions

Salary payment with A-tax

Insurance and pension solutions in accordance with collective agreements

This means you do not need to:

Start a sole proprietorship or limited liability company

Register for F-tax

Manage accounting, VAT, and employer contributions yourself

For the customer, it looks like they are hiring a company. For you, it feels like a regular job, but with the freedom to choose your own assignments.

When is it appropriate to invoice without a company?

Invoicing without a company is particularly suitable when you:

Trying out freelance life and want to test the waters before starting your own company

Freelancing alongside studies or employment

Have recurring assignments but don't want to spend time on administration and accounting

Want security with salary, insurance, and collective agreements without becoming a full-time employee

Typical users of Worknode include:

Consultants and developers

Creators, designers, photographers

Marketers, writers, project managers

Individuals who perform occasional assignments for companies

How to invoice without a company - step by step

Create an account

You register with Worknode and enter your account details so that your salary can be paid out.

Send your invoice

When the assignment is complete, log in and register the customer, fill in the assignment, add hours or amounts, and send the invoice via Worknode. The invoice is sent from Worknode to your customer, with F-tax and correct VAT.

You will receive your salary

Once the invoice has been paid, the money will appear in your Worknode balance. From there, you can request your salary. Worknode handles all reporting to the Tax Agency, pays employer contributions, and ensures that you are covered by the relevant insurance. You can focus on your assignments, not administration.

Welcome to the world of easy invoicing without a company!

What is your take-home pay after taxes and fees when you invoice without a company?

How much you receive depends on:

How much you charge

What municipal tax you pay

If you receive a salary as full-time income or additional income

A simplified example:

You invoice SEK 20,000 excluding VAT for an assignment.

Worknode fees are charged according to the model you have chosen (FLEX or PRO).

The remainder is used as a basis for salary, tax, and employer contributions.

The result is a net salary in your account, plus vacation pay and a security package via collective agreement. On the Worknode website, you can use the salary calculator to see an estimate of what you will earn for your specific assignments.

Security: salary, insurance, and collective agreements

Many services that offer "invoicing without a company" focus only on the payment itself. Worknode is built more like a small back office department for you.

With Worknode, you get:

Salary with A-tax and payslip

Collective agreement-based terms and conditions

Insurance linked to your work

Occupational pension according to the solutions offered by Worknode

Help with questions about assignments, agreements, and terms and conditions

This allows you to take on freelance assignments while still having a clear employer behind you.

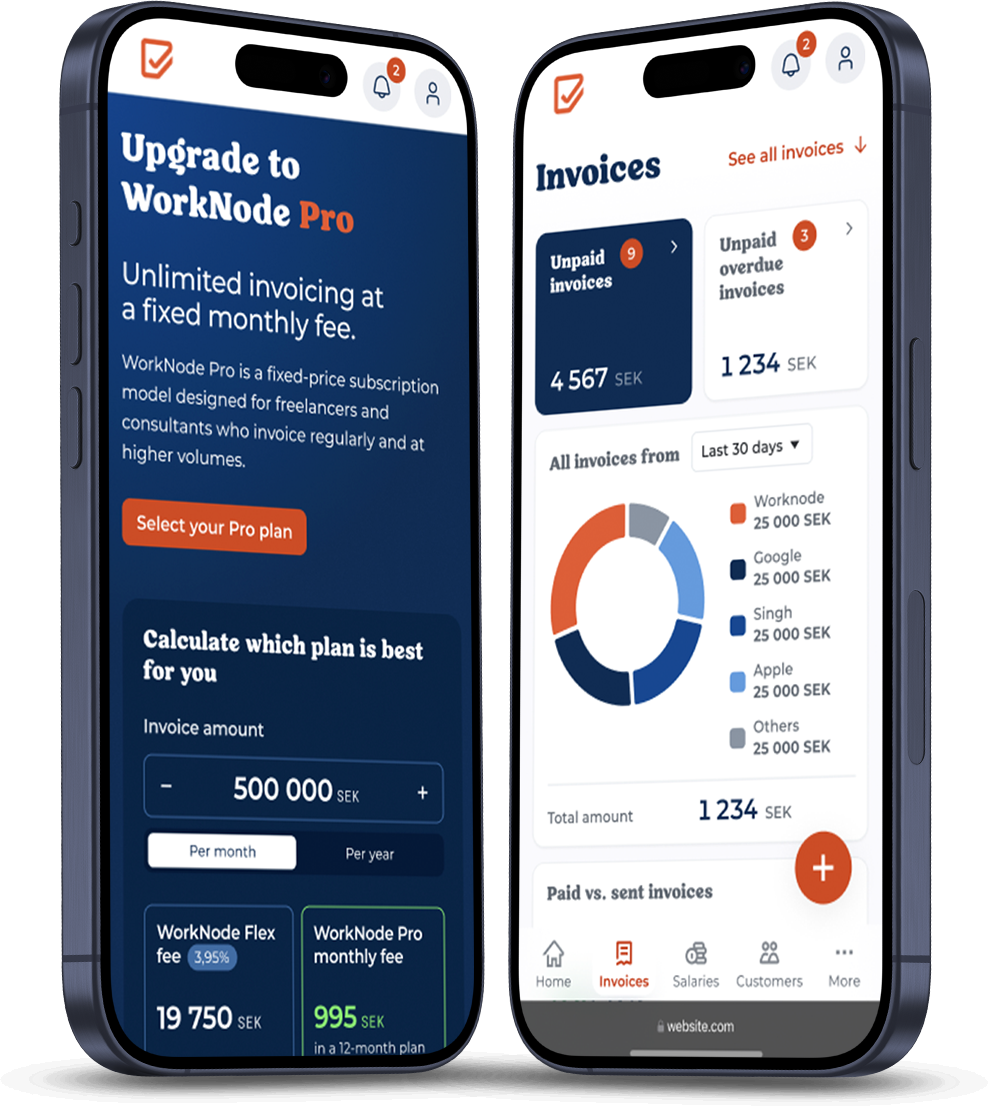

Worknode FLEX vs PRO – which model is right for you?

Whether you invoice occasionally or monthly, we have a solution to suit you. Choose between a flexible percentage fee or a fixed monthly rate - and get full peace of mind, support and employer responsibility in return.

Pay-as-you-go.

For those who invoice occasionally.

✓ 3.95% per invoice

✓ No fixed cost, no commitment period

✓ Easy start: bill directly, pay only when you use the service

3.95% of the invoiced amount

Fixed price.

For those who mean business.

✓ Fixed monthly price - unlimited billing

✓ Suitable for those who invoice 25 000+ SEK/month).

✓ Save thousands of dollars each month compared to percentage-based services

From SEK 995/month

Invoice without a company or start your own company?

Invoicing without a company and running your own company are two different ways of working.

Invoice without a company via Worknode:

No start-up or company registration

No accounting or annual report

Worknode is the employer and assumes employer responsibility.

You receive a salary, security, and insurance

Start your own company (sole proprietorship or limited liability company):

More administration and responsibility

You are responsible for accounting, VAT, and taxes.

May be more profitable in the long term for some, but requires more time and knowledge

Several "hidden costs" such as insurance, accounting software, bank fees, accounting consultants, etc.

A common approach is to start by invoicing without a company via Worknode, and later, if you wish, start your own company when you have stable assignments and feel ready to take the next step.

Who can use WorkNode?

Worknode is open to most types of assignments where:

You invoice companies, organizations, or sometimes private individuals.

The assignment is legal and insurable.

There is a clear contract or order

Examples of common assignments:

Consulting assignments in IT, technology, HR, finance

Projects in marketing, design, photography, and film

Lectures, training courses, and workshops

Production, technology, and industrial projects via clients

Not sure if your assignment is valid? Then you can contact Worknode's support team and get help assessing it before sending the invoice.

Try invoicing without a company with Sweden's most convenient and reliable service.

Freelance smarter with WorkNode.

Frequently asked questions about invoicing without a company (FAQ)

Do I need F-tax to invoice without a company?

No, you don't normally need to pay F-tax when you invoice via Worknode. Worknode acts as the employer and invoices the customer. You receive your salary with A-tax, just like in a normal job. F-tax or FA-tax applies if you also run your own business on the side.

Read more at Invoicing without F-tax

How is income taxed when I invoice via Worknode?

When you invoice via Worknode, you receive your salary with A-tax. This means that Worknode deducts tax and pays employer contributions to the Swedish Tax Agency. You receive a payslip and the information is reported to the Swedish Tax Agency, so you declare the income as salary, not as self-employment.

How much does it cost to invoice without a company?

The cost depends on which model you choose at Worknode. With FLEX, you pay a percentage fee on what you invoice. With PRO, you pay a fixed monthly fee and avoid percentages on your invoices. On Worknode's pricing page, you can see the exact fee and calculate what is most advantageous for you.

Can I invoice foreign customers without a company?

In many cases, you can invoice foreign companies via Worknode, but it depends on the assignment and the country. Contact Worknode support for help with the setup, especially if the customer is located outside the EU or if specific VAT rules apply.

Can I have my own business and invoice through Worknode?

Yes, it is common for people to run their own business and use Worknode. For example, you can have a sole proprietorship for certain assignments and invoice other assignments via Worknode to receive a salary with A-tax and a collective agreement. The important thing is that you keep the assignments separate and follow the Swedish Tax Agency's rules, especially when it comes to F-tax and A-tax.