Invoicing without F-tax – how to do it legally and securely

Don't have F-tax but want to be able to invoice for a job? You're not alone. On this page, we'll go through how you can invoice without F-tax in a way that is both legal and secure, and how Worknode can become your employer so that you don't have to take on employer responsibility yourself.

What does it mean to invoice without F-tax?

Invoicing without F-tax means that you perform work in exchange for remuneration, but are not approved for F-tax and therefore cannot invoice as an entrepreneur on your own. In practice, this often means that you:

is employed elsewhere and wants to take on an extra assignment

are a student, between jobs, or about to test your own idea

has previously owned a business but no longer has F-tax status

The important thing is not which form you use, but who takes responsibility for taxes, social security contributions, and employer responsibilities. Either your client does this, or you use a self-employment company such as Worknode, which takes over the responsibility and pays your salary.

What do the rules say about invoicing without F-tax?

If you do not have F-tax, you cannot act as a regular supplier in the same way as a company. Some basic principles that are good to start from:

The client may need to treat the payment to you as salary and assume employer responsibility.

All income must be declared, regardless of whether you invoice yourself, receive a salary, or are self-employed.

In the case of recurring assignments for profit, the Swedish Tax Agency may assess that you are conducting business activities, in which case you will need to register a company and pay F-tax.

If the roles are unclear, things can quickly become complicated for both you and your customer. That is why self-employment solutions exist: they step in as the formal employer and invoice your customer with F-tax, while you receive your salary with A-tax.

Alternatives if you do not have F-tax

There are essentially three ways to take on assignments if you do not have F-tax status.

1. Your customer pays you as a private individual

Your client may choose to pay the compensation as salary. In that case, they become your employer and are responsible for:

tax deduction

employer contributions

reporting to the Tax Agency

This may work for smaller, one-off assignments, but many companies want to avoid administrative work and labor law risks. That is why they often say no when someone without F-tax wants to invoice directly.

2. Start your own business and apply for F-tax

If you know you will have ongoing assignments, it may be appropriate to:

start a sole proprietorship or limited liability company

apply for F-tax

take responsibility for accounting, VAT, employer contributions, and taxes

It gives you complete freedom, but also requires you to take on the entire administrative package. For many who just want to get started, test an idea, or work part-time, it's too big a step.

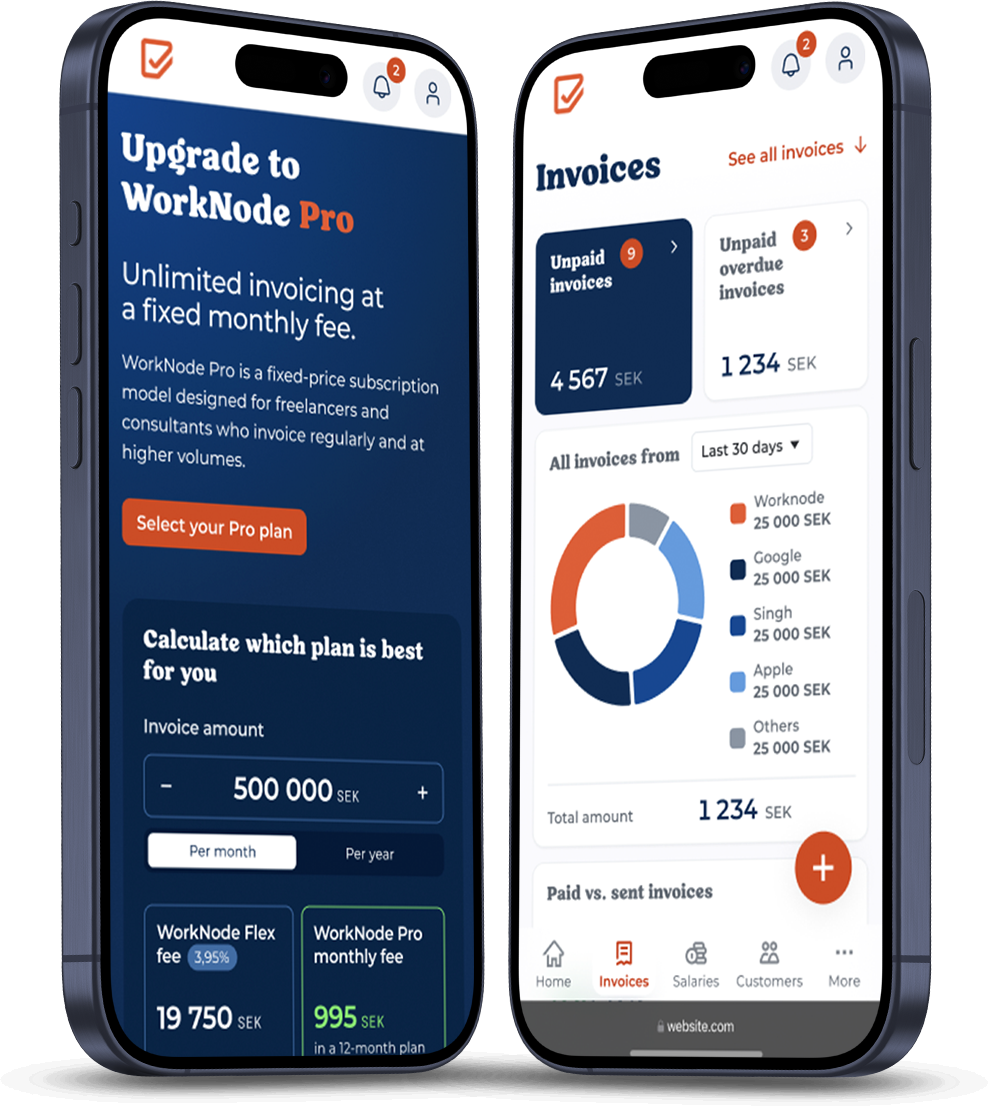

3. Invoice without F-tax via self-employment with Worknode

The third option is to use a self-employment company. In that case:

Worknode becomes your employer

Worknode invoices your customer with F-tax

handles taxes, social security contributions, insurance, and payroll

you receive a salary with A-tax, collective agreements, and security

You don't need to register a company, you don't need to have F-tax, and you don't have to take on employer responsibility towards the customer. For your customer, it looks like any other supplier invoice from a Swedish company with F-tax.

Step by step - how to invoice via Worknode

Create an account

You create an account with Worknode and register your details. You don't need a company registration number or an F-tax certificate, your personal identification number is sufficient. You and the customer agree on what you will do, the price per hour or fixed price, and when the assignment will be carried out. It is important that the customer knows that you invoice via Worknode and that the invoice comes from us with F-tax.

Send your invoice

When the assignment is complete, log in and register the customer, fill in the assignment, add hours or amounts, and send the invoice via Worknode. The invoice is sent from Worknode to your customer, with F-tax and correct VAT.

Get your salary in your account

Once the customer has paid the invoice: Worknode registers the payment, calculates tax, social security contributions, and fees to Worknode, and pays your salary to you, with a pay slip and everything reported to the Tax Agency.

The result: you can invoice without paying F-tax, but receive a salary as if you were an employee, including a security package and collective agreement.

Welcome to a world where invoicing without F-tax is easy!

Common mistakes when trying to invoice without F-tax

1. Send your own invoices without clear tax handling

Simply sending a PDF invoice from your own name without F-tax and hoping that it will "work out" can create problems. The customer may get the wrong impression of the division of responsibility, and you risk that neither taxes nor fees are handled correctly.

2. Lack of clarity for the customer about who does what

If the client believes that you are a self-employed person with F-tax, but you are in fact acting as an employee, questions may arise afterwards regarding employer responsibility, insurance, and the work environment.

3. No plan for taxes and tax returns

Even if you are paid "as a private individual," your income must be reported. For many people, filing their tax returns comes as an unpleasant surprise if they haven't kept track of their income from the outset. With Worknode, tax deductions are made directly, which reduces the risk of you making a mistake.

Common situations where you do not have F-tax but want to invoice

You are employed and receive a side assignment

You already have a job with A-tax, but you have the opportunity to:

give a lecture

take on a freelance assignment

take on an extra consulting job on the side

Your employer does not want to invoice on your behalf, and you do not have F-tax. Through Worknode, you can invoice for the assignment without starting a company, and you will receive the compensation as a salary.

You are a student or between jobs

You receive one or more assignments via networks, previous workplaces, or platforms. It's too little to start a business, but too much to just "ignore" reporting. By invoicing via Worknode, you ensure that everything is correct, while maintaining flexibility.

You have closed your business but are receiving new inquiries

You may have closed your sole proprietorship or had your F-tax status revoked, but still receive requests for assignments. Instead of taking a chance without F-tax status, you can let Worknode invoice on your behalf until you know whether you want to scale up again.

Why use WorkNode when you don't have an F-tax number?

You can take on assignments even if you are not approved for F-tax.

Your customer will receive a correct invoice from a Swedish company with F-tax.

Worknode assumes employer responsibility, reports taxes and fees, and pays your salary.

You are covered by collective agreements and insurance, instead of being completely outside the system.

When or if you later want to start your own business, you can bring your experience, customers, and pricing with you, without having to take any legal risks along the way.

Try invoicing without a company with Sweden's most convenient and reliable service.

Freelance smarter with WorkNode.

Frequently asked questions about invoicing without F-tax (FAQ)

Is it legal to invoice without F-tax?

Yes, it is legal to charge for a job even if you do not have F-tax, but someone must take responsibility for tax and social security contributions. Either your customer does this by paying you a salary, or you use a self-employment company such as Worknode, which invoices with F-tax and pays you a salary.

Can I invoice a company without F-tax?

You cannot invoice as a regular company if you do not have F-tax. Either the company treats you as an employee and takes on employer responsibility, or you let Worknode act as the supplier and send the invoice with F-tax on your behalf.

What happens if I invoice without F-tax on my own?

If you send invoices without being approved for F-tax, it may become unclear who is responsible for taxes and fees. The company that pays you may need to treat the payment as salary, and you risk problems later if the income is not reported correctly.

Do I have to start my own business to be able to invoice without F-tax?

No. If you use Worknode, you do not need to register your own company or apply for F-tax. Worknode has F-tax and acts as your employer and as a supplier to your customer.

When should I switch from self-employment to running my own business?

If you start getting regular assignments, higher turnover, and want to deduct your own investments, it may be the right time to start your own business with F-tax. Until then, self-employment via Worknode is often a convenient way to invoice without F-tax while still receiving a salary and security.